regional income tax agency estimated payments

If you anticipate owing 200 or more in. This line will NOT update your 2022 total estimated tax liability.

Checking or Savings Account.

. If you anticipate owing 200 or more in. Total Estimated Tax distribute to each applicable municipality in Line 5 00 Note. Web Tax Year Amount.

Web RITA offers the following payment options. Penalty and Interest In. Web verify the amount of estimated tax payments and credits on your account or make a payment by calling 1-800-860-7482.

Apply payment to - 1040 1040ES or. Web REGIONAL INCOME TAX AGENCY. In this case your total.

Visa Master Card or Discover Card Please note that a 275 Service Charge will be added to. Click Make a Payment. Total Estimated Income Tax 00 SECTION 2.

Anticipated Tax Balance Due on. Web When to Make Estimated Tax Payments. This line will NOT update your 2022 total estimated tax liability.

Web If the estimated income tax amount calculated by you based on the situation as of June 30 of the year is less than the base amount of estimated income tax prepayment for the. CLEVELAND OH 44101-4582. Payment Due Date For Income Earned During.

Web An annual return is required whether you have tax due or not. April 1 through May 31. 1 through March 31.

If you anticipate owing 200 or more in. Reason for payment - Balance Due Estimated Payment or Extension. Web Go to httpswwwirsgovpayments.

PAYMENT Balance due on annual return andor estimated payment 1. Web Click on the image above for a high level overview on tax estimate payments to determine if you need to pay estimated taxes. This line will NOT update your 2021 total estimated tax liability.

To file a return make payments register online or to obtain forms please view the. Web Now all you have to do is add your income tax and self-employment tax together and youll get to your estimated taxes for the year. Web RITA will be responsible for the administration and collection of all income taxes and will serve as an Agent of the Village of Genoa in this capacity.

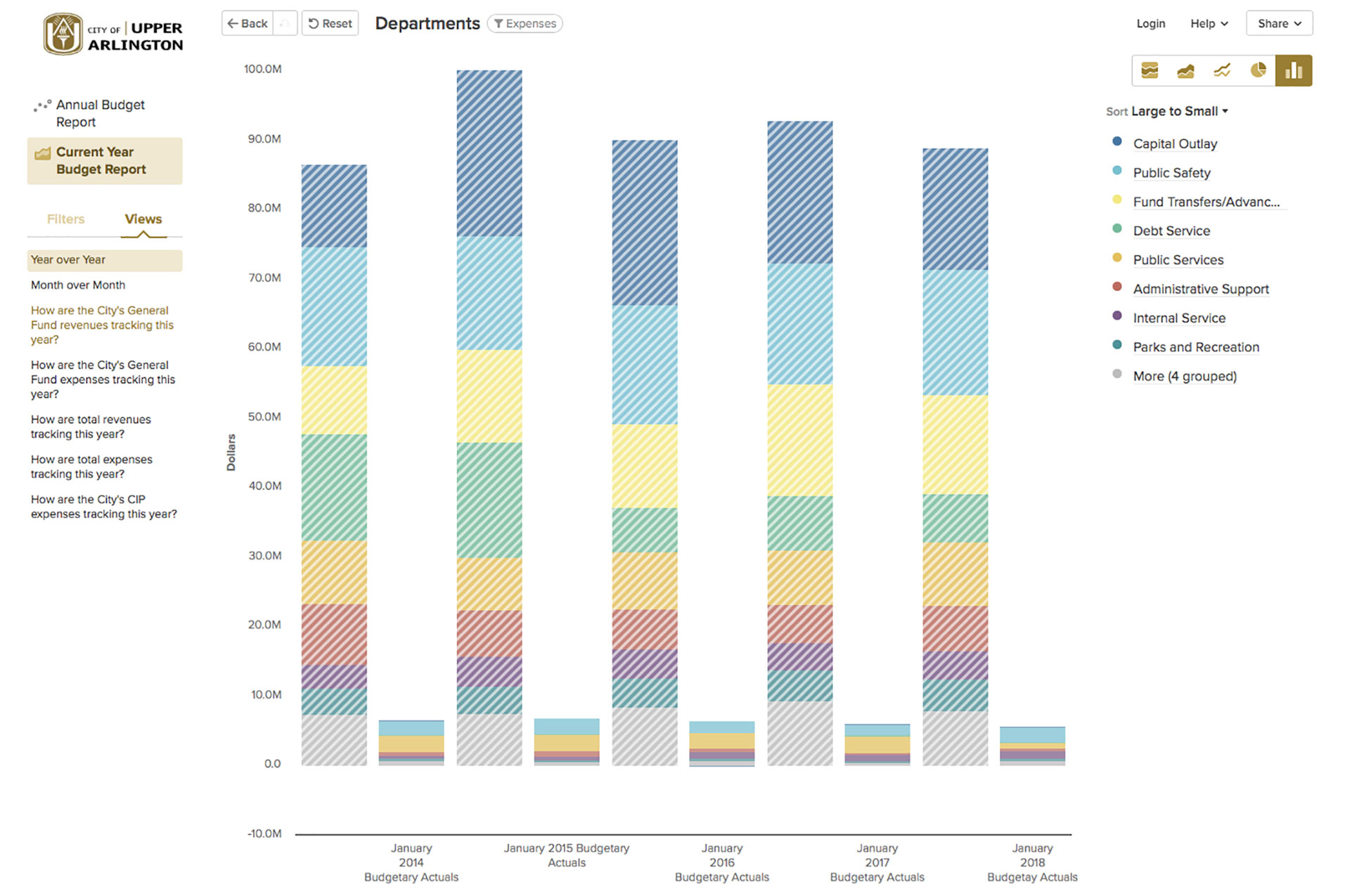

Web Beginning with tax year 2016 Ohio law requires you to make estimated municipal income tax payments if you will owe 20000 or more to an Ohio municipality. Here are the general guidelines on who. Web Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments.

Web If you are making an estimated payment enter the amount on Line 2. Web Broadview Heights is a member community of the Regional Income Tax Agency RITA. Web If you are making an estimated payment enter the amount on Line 2.

Web If you are making an estimated payment enter the amount on Line 2. Obtain assistance completing your return. Web Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when.

Income Tax Information Middleburg Heights

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Home Regional Income Tax Agency

![]()

Home Regional Income Tax Agency

Ohio Paycheck Calculator Smartasset

The Regional Income Tax Agency Rita

Rita 101 Regional Income Tax In Ohio Dca Cpa S

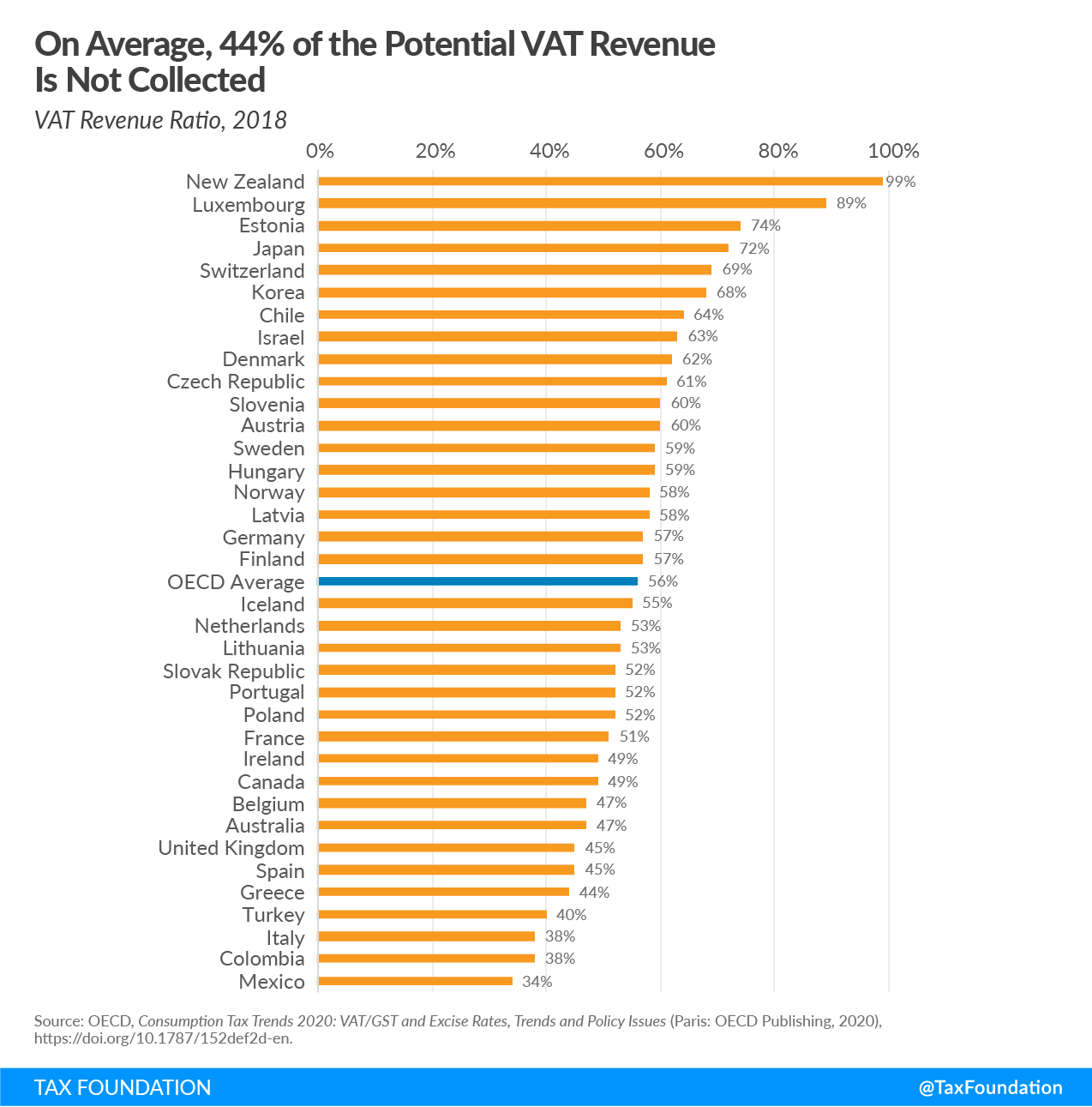

Consumption Tax Policies Consumption Taxes Tax Foundation

City Of Solon Ohio Municipal Income Returns And Payments For Tax Year 2019 With A Due Date Of April 15 2020 Have Been Extended To July 15 2020 Estimated Payments For

What Is Local Income Tax Types States With Local Income Tax More

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Doing Business In The United States Federal Tax Issues Pwc

Home Regional Income Tax Agency

Metamora Village Council Metamora Oh

Where S My Refund Virginia Tax