child tax credit 2022 tax return

The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

Monthly Child Tax Credit Would Be A Train Wreck People S Policy Project

Individuals whose incomes are below 12500 and couples below 25000 may be able to file a.

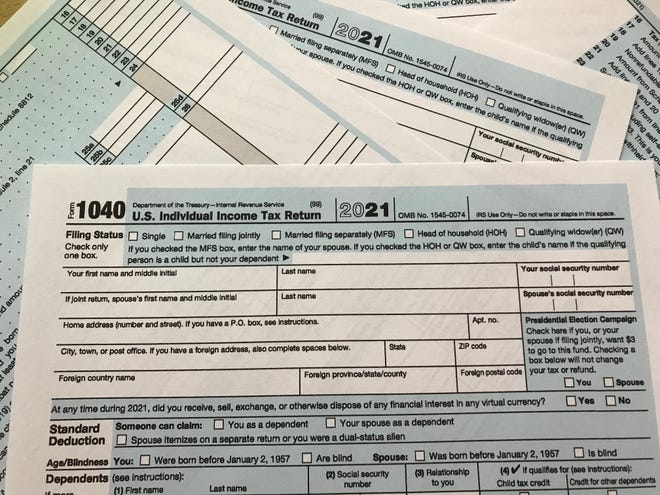

. The child tax credit CTC will return to at 2000 per child in 2022. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. E-File Directly to the IRS.

Expanded Child Tax Credit available only through the end of 2022. You can get half of your. However taxpayers with the.

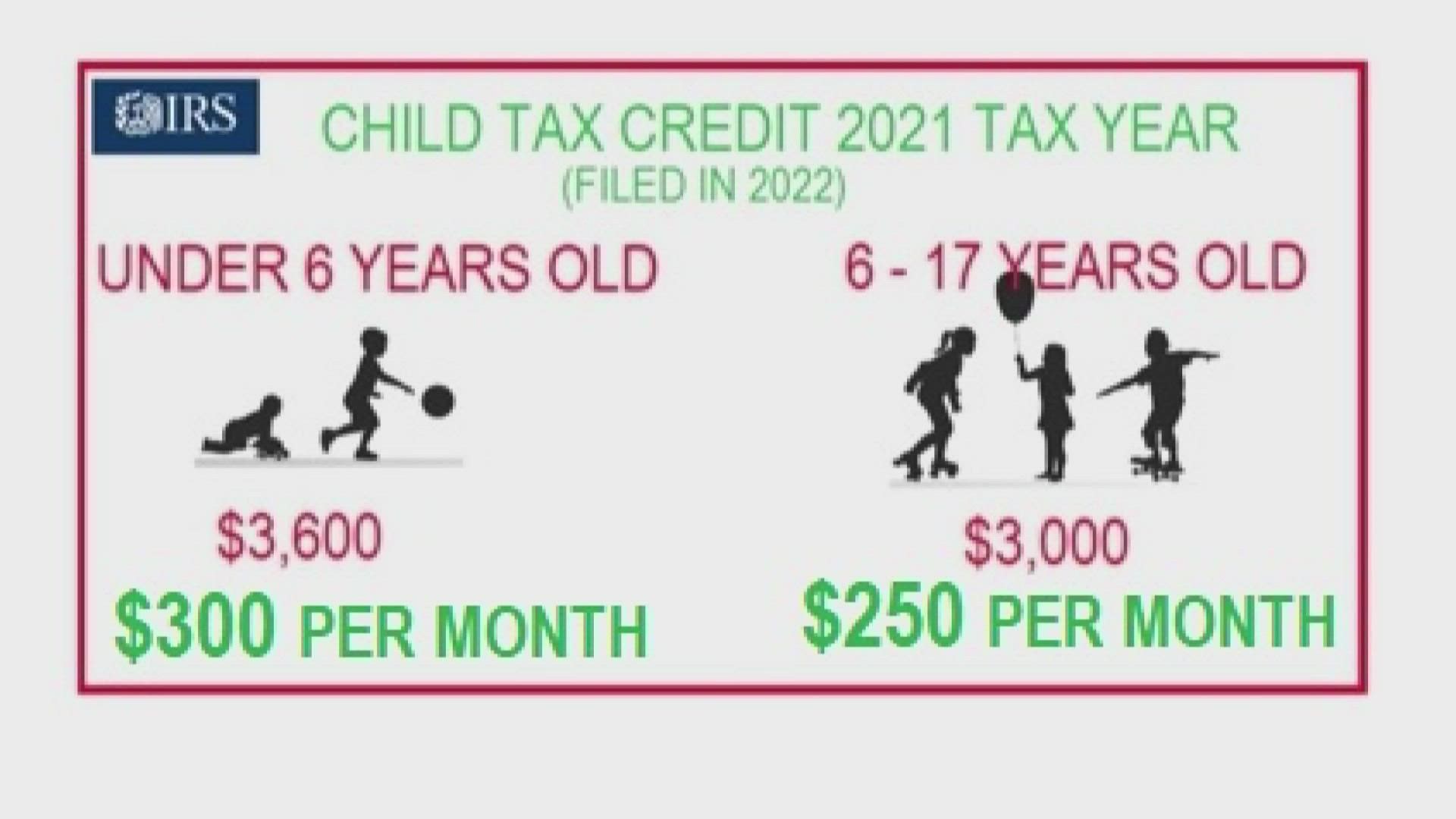

In the meantime the expanded child tax credit and advance monthly payments system have expired. The big thing is that there are a ton of tax changes related to stimulus funds and other benefits people may. The payment will be 250 for each qualifying child.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Families could be eligible to. This means that the credit will revert to the previous amounts.

The 2022 tax season promises to be different from recent years. 1 day agoThe IRS said 2021 tax returns can also be filed at ChildTaxCreditgovfile. The monthly payments were up to 250 or 300 per child for a period of.

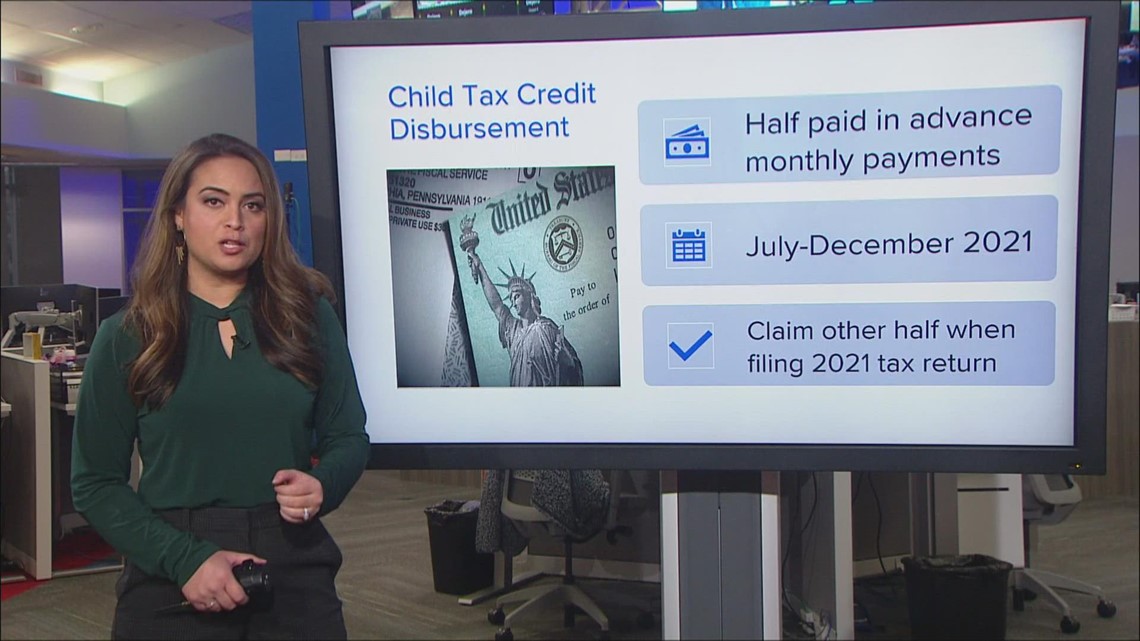

Your tax refund may come march 1 more tax refunds will be paid march 1 the 2022. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to eligible. The amount you will receive depends on your income and filing status but the credits.

If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during. Advance Child Tax Credit Payments in 2021. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

The Child Tax Credit provides money to support American families. This tax credit helps offset the costs of raising kids and is worth up to 3600 for each child under 6 years old and 3000 for each child between 6 and 17 years old. Ad Home of the Free Federal Tax Return.

Families must have at least 3000 in earned income to claim any portion of the credit and can receive a. If youre eligible but did not receive any monthly advance Child Tax Credit payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit on. Ad Access IRS Tax Forms.

IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that. Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as. As a result nearly 115000 families across Rhode Island will be able to receive up to 750 in a child tax rebate.

The American Rescue Plan expanded the credit to as. Everything is included Premium features IRS e-file 1099-MISC and more. The child tax credit can help you reduce the taxes that you owe by as much as 1000 for each child under the age of 17.

Colorado is rolling out a new child tax credit in 2022 that is similar to the federal support. Ad Browse Discover Thousands of Reference Book Titles for Less. Here is some important information to understand about this years Child Tax Credit.

If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of. This means that next year in 2022 the child tax credit amount will return. Advance payments of the enhanced child tax credits were sent to people from July to December 2021.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. An online tax filing tool now lets users claim the 2021 earned income tax credit in addition to the child tax credit and third stimulus payments. The tax credits part of President Joe Bidens 19 trillion coronavirus relief program increased payments to up to 3600 annually for each child age 5 or younger and.

Automatic monthly payments for nearly all working families. 1 day agoHouseholds making less than 12500 and married couples making under 25000 can turn in a simplified tax return via a website the federal government built for the child tax. Complete Edit or Print Tax Forms Instantly.

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

Child Tax Credit Will Monthly Payments Continue In 2022 King5 Com

Tax Credits For Your 2022 Tax Return The One You File In 2023

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

2021 Child Tax Credit How Will It Affect My 2022 Tax Return As Usa

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Top 5 Things To Remember When Filing Income Tax Returns In 2022

2022 Tax Refund How Child Tax Credit Affects Parents Across America Us Patch

Child Tax Credit Payments Are Done How To Get Yours Wfmynews2 Com

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Www Irs News In English And Spanish File A 2021 Tax Return To Get The Remainder Of Your 2021 Child Tax Credit

2022 Irs Tax Advice What You Need To Know About Child Credit And Stimulus Checks Kob Com

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

Irs Issues Information Letters To Advance Child Tax Credit Recipients And Recipients Of The Third Round Of Economic Impact Payments Taxpayers Should Hold Onto Letters To Help The 2022 Filing Season Experience

Stimulus Update Here S Why Some Families Will Receive 3 600 Child Tax Credit Payment In 2022 Silive Com